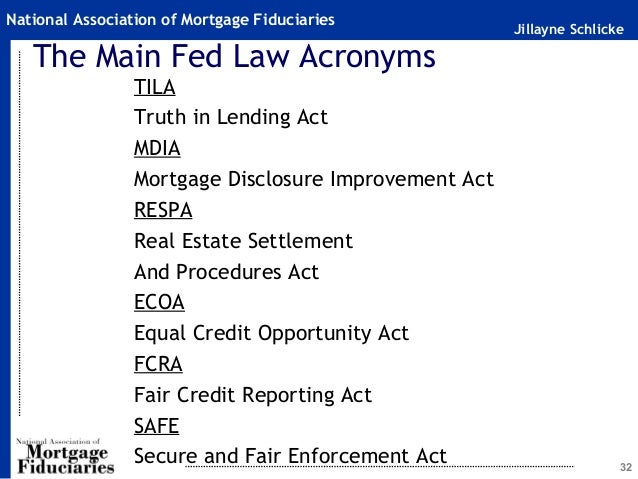

Mortgage Disclosure Improvement Act

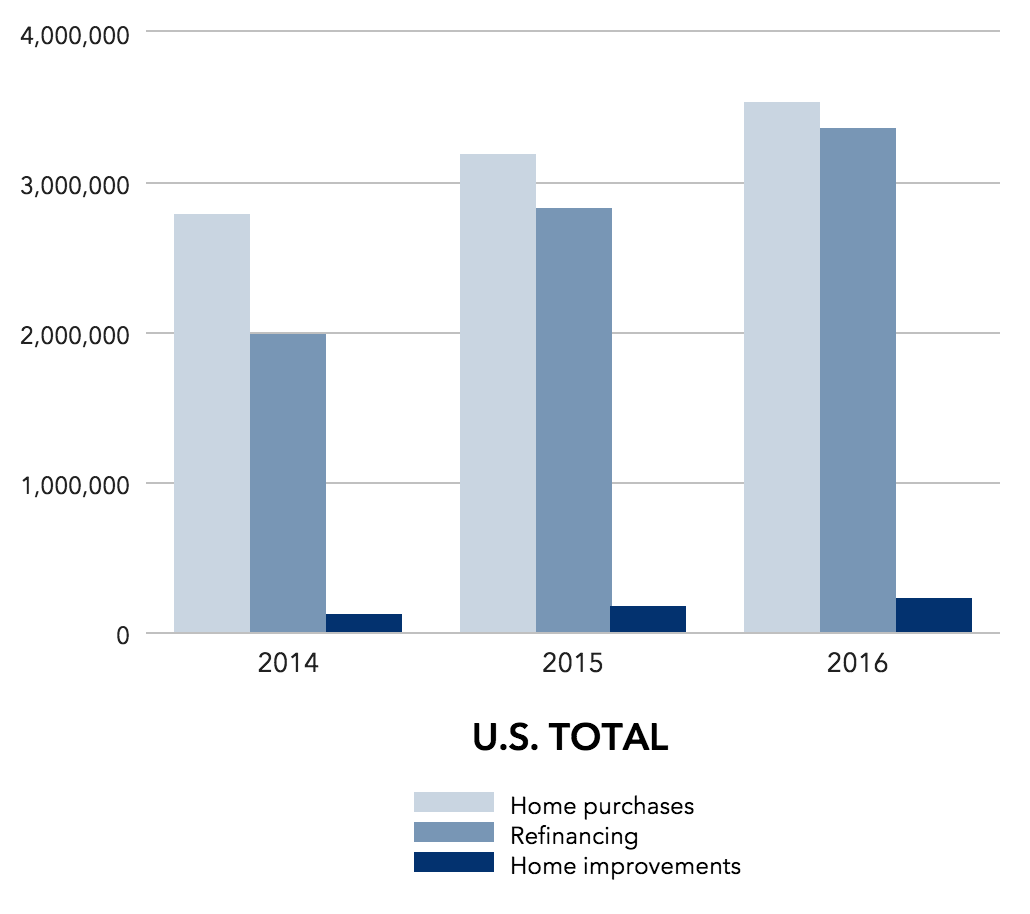

Mortgage Disclosure Improvement Act. The Home Mortgage Disclosure Act (HMDA) is a federal law that requires lenders to keep certain information about their mortgage applicants. Saturdays are only considered business days if the mortgage company is open to the public as standard operating hours on Saturday.

The Home Mortgage Disclosure Act (HMDA) is a federal law that requires lenders to keep certain information about their mortgage applicants.

The MDIA requires transaction-specific TILA disclosures to be provided within three business days after an application is received and before the consumer has paid a fee, other than a fee for obtaining the consumer's credit history.

Its main purpose is to make certain early disclosure requirements mandatory on non-purchase transactions that were. This is a Compliance Aid issued by the Consumer Financial Protection Bureau. PredProtect ® newly enhanced for easy MDIA compliance.

Rating: 100% based on 788 ratings. 5 user reviews.

Jacquelyn Tapper

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Mortgage Disclosure Improvement Act"

Post a Comment